- DCC Spaces

- Services

- About

- Careers

- Blogs

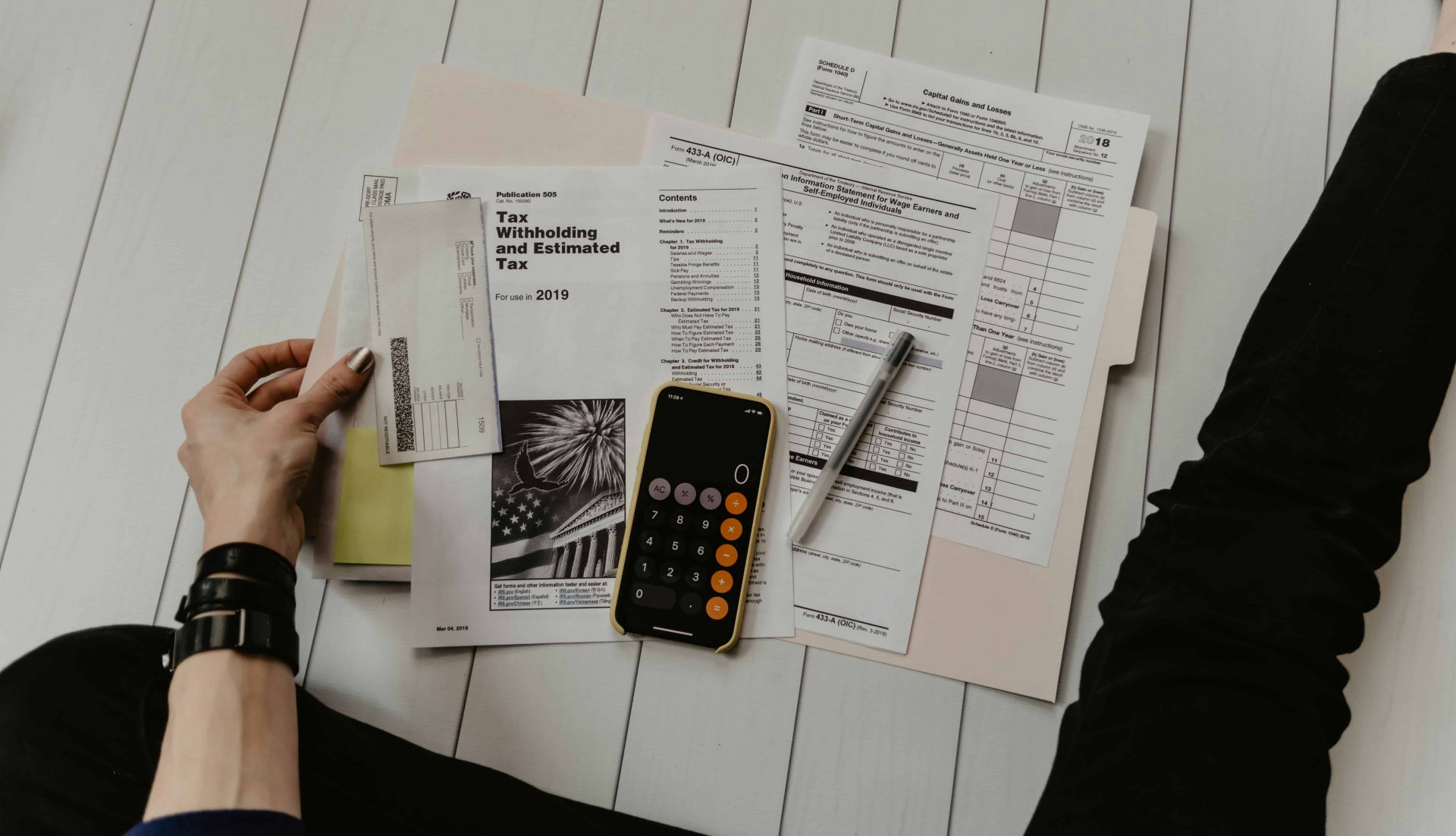

Recently, Revenue Notification Circular 36-2024 issued by the Bureau of Internal Revenue (BIR) has significant ramifications for businesses. Let’s take a closer look at the highlights:

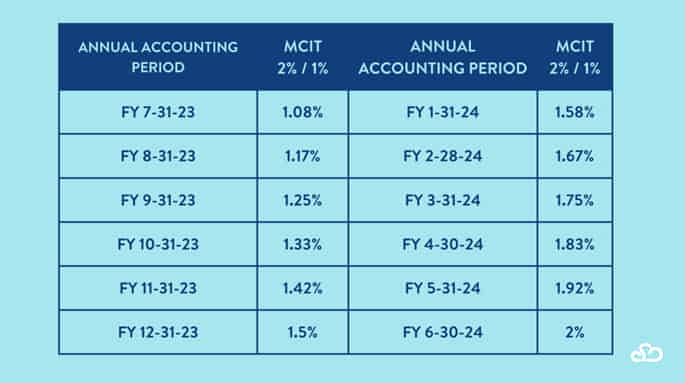

The Corporate Restructuring and Corporate Tax Act had a significant impact on MCIT rates. Let’s break it down:

De Castro Consulting takes a closer look at how the Minimum Corporate Income Tax (MCIT) is calculated:

This number corresponds to the taxable period and provides a simple method for determining MCIT payments. Recall that MCIT ensures that businesses contribute minimal amounts of money to support the government and pay for essential services.